The Citi Mobile® App

A simpler, faster and safer way of banking is here.

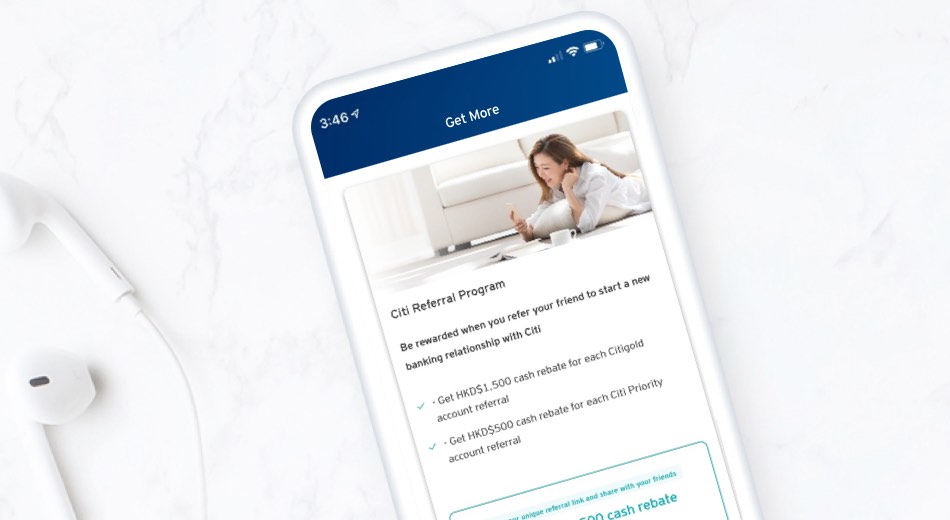

Get more with just one app

Designed with you in mind.

We’ve been working hard to bring you a quicker and smarter mobile banking experience that continues to be all about you.

You’ll now have greater flexibility at your fingertips, with personalized views and new features designed to be quick and hassle-free.

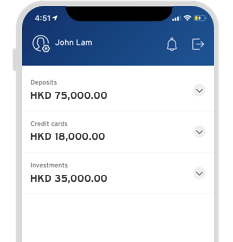

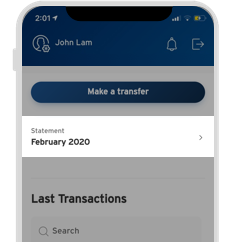

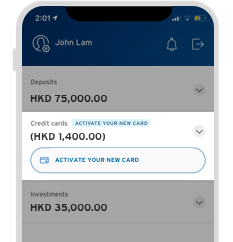

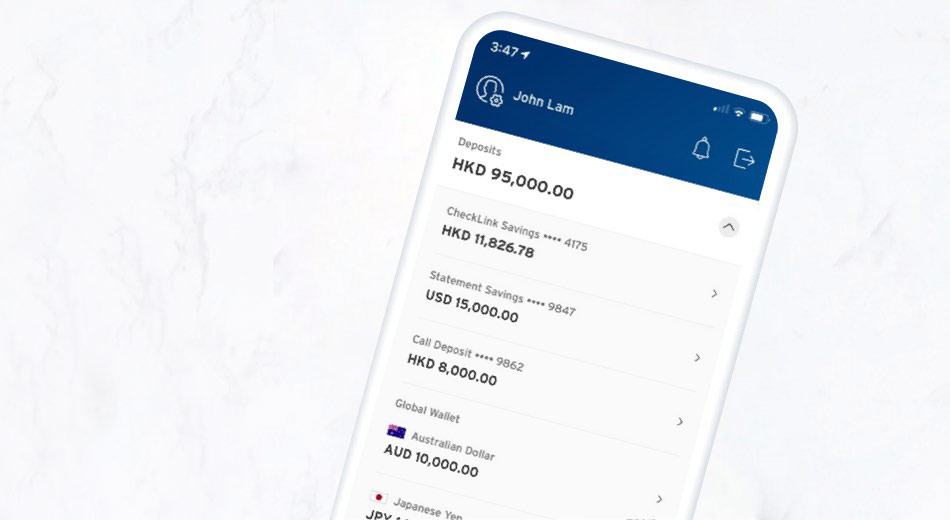

Everything at a glance

Exchange foreign currencies at preferred FX rates

Citibank Global Wallet – activate the function and buy foreign currencies at your preferred rates. You may then use your Debit Mastercard to shop on international websites directly with your foreign currency accounts. You won’t be charged any handling fee.

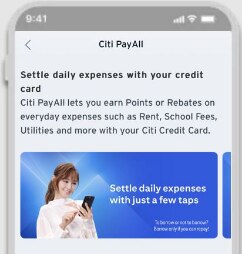

Other features for your banking needs

Installation Guidelines for Android Users (Without Google Play Access only) Android APK Download Security Tips

1. What is Face ID/fingerprint login? 2. Which phone models are eligible for Face ID/fingerprint login? 3. Is Face ID/fingerprint login safe? 4. I have a few fingerprints stored in my phone. Do all of them have access to my Citibank account? 5. What if my Face ID/fingerprint login - enabled phone is lost or stolen? 6. Can I disable Face ID/fingerprint login for Citi Mobile®App at any time? 7. How long is my Face ID/fingerprint login enrollment for the Citi Mobile®App valid? 8. Will the Face ID/fingerprint login for the Citi Mobile®App be disabled once I change my mobile number or service provider? 9. Why was my Face ID/fingerprint login turned off?

1. What is Push Notifications? 2. How can I view or maintain my Citi Alerts Service enrollment status? 3. Why did I stop receiving Citi Alerts SMS? 4. How can I receive my alerts via both SMS and Push Notifications? 5. I don't want to receive all types of alerts via Push notifications. Can I receive some alerts via Push Notifications and some alerts via SMS and email? 6. I have disabled from Push Notifications before and now I want to enroll in again, can I receive alerts via both Push Notifications and SMS? 7. How will my Email Notifications be impacted by enrolling for Push Notifications? 8. How do I disable from Push Notifications completely? 9. Where will I see the alerts that were sent to my mobile phone via Push Notifications? 10. How long will the alerts be stored in the app and how can I delete these messages? 11. If I change my alert threshold limit in Citi Mobile® App, will it change the threshold limit for SMS and Email Notifications for the same alert? 12. I lost my phone. How can I disable Push Notifications? 13. I am not able to enable Push Notifications on my device. Why? 14. I have changed mobile device. Can I see all my previous Push Notifications on my new device? 15. Why can’t I receive Push Notifications sometimes? 16. Why did I stop receiving Push Notifications on my device?

1. How can I get the Citi Mobile®App? 2. Why am I not able to use Citi Mobile®App on my Android™ mobile device? 3. Why am I not able to use Citi Mobile®App on my tablet? 4. How can I create an User ID and password in order to log on to Citi Mobile®App? 5. Why is it not necessary/required to input a User ID? Why does the 'User ID' field disappear? 6. I have to use different User IDs to log in to manage my personal and company accounts. Why can't I input other user ID? 7. I have input a correct password. Why does log in fail? 8. I have already reset my password and input a correct one. Why does log in fail?

Disclaimer

Android and Google Play are trademarks of Google Inc.

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc., registered in the U.S. and other countries.

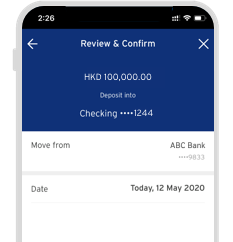

The screens and information displayed are for illustration purpose only. Please refer to the Citi Mobile® App for actual screens.