CITI PLUS® CREDIT CARD

Applicable to Citi Plus Account Holder only

Earn more + Rewards

Top 6 credit card features

Citi Plus Credit Card is designed with a host of powerful features. Access the features and enjoy the ease of making payments at your convenience. The cards also offer a wide range of privileges to facilitate a wholesome experience.

Freedom to do more with the new

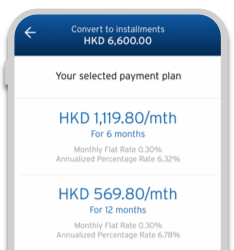

Citi Mobile® App

Get the Citi Mobile App to enjoy a digital banking platform like having a bank in your hands. From checking your accounts in one place to making secure transactions, and lot more, the Citi Mobile App gives you the freedom to access and use your accounts anytime and anywhere.

Promotion

With a Citi Plus Credit Card enjoy amazing deals and promotional offers on various categories. Utilize the exclusive benefits and privileges and make the most out of your Citi card.

Earn more rewards in less than 10 minutes

Applying online for a Citi Plus Credit Card is easy.

Min. annual income HK$120,000 / Min. HK$80,000 in Citi Plus banking account

Age 18 or older

Applicable to Citi Plus Account Holder only

Welcome offer of HK$800 Cash Rebate

Welcome Offer Terms and Conditions

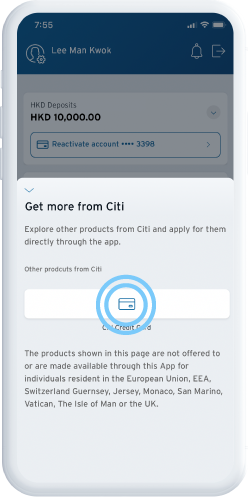

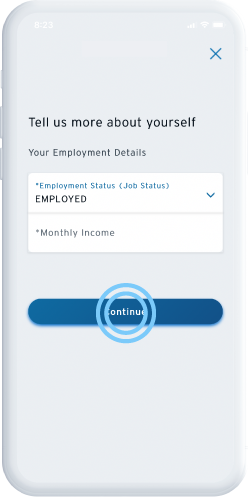

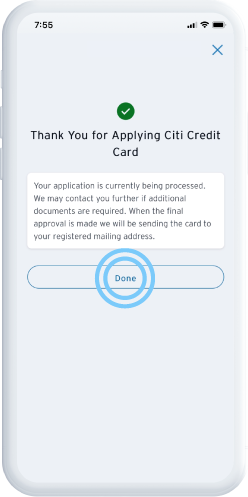

Apply Citi Plus® Credit Card with Citi Mobile® App?

(Mobile application flow is currently only applicable for Citi Plus Account Holder with no Citi Credit Card)

To borrow or not to borrow?

Borrow only if you can repay!

Useful Links

Activate your Credit Card

Cardholder's Guide

Citi ThankYou Rewards

Year Round Offers

Tips: If you cannot see the “+” button on the dashboard, please update your Citi Mobile® App and retry.

Citi Plus Credit Card

General Terms and Conditions:

- Unless otherwise specified, these programs apply to principal and supplementary cardholders ("Cardholders") of Citi Plus Credit Card issued by Citibank (Hong Kong) Limited ("Citibank") ("Eligible Card").

- Citi ThankYou Rewards Terms and Conditions apply for all Points related offers. For details, please visit citibank.hk/citirewards

- If Cardholders have subsequently cancelled / reversed any transactions in respect of which offers are rewarded, Citibank reserves the absolute right to charge the equivalent value of such offers directly from the Eligible Card account without prior notice.

- Cardholders must maintain valid Eligible Card accounts with good credit record in order to be eligible for the offers. In case there is any fraud / abuse, Citibank reserves the absolute right to charge the equivalent value of the offers rewarded under these programs directly from the Eligible Card account without prior notice, forfeit the Cardholder's eligibility to be entitled to the offers, and/or suspend the Eligible Card account for investigation without prior notice.

- Citibank shall not be responsible for any matters in relation to the related products or services. The respective merchants are solely responsible for all obligations and liabilities relating to such products or services and all auxiliary services.

- Citibank Hong Kong and respective card associations may at our absolute discretion to suspend, deny or stop any transactions for observing the obligation to comply with applicable laws, regulations, subsidiary legislation, court orders, directives, guidelines and/or requirements of courts, regulatory authorities and government authorities (including the Hong Kong Monetary Authority and the Office of Foreign Assets Control of the United States Department of the Treasury) and any policies or guidelines of Citibank or Citigroup Organisation.

- Citibank reserve the right to amend the terms and conditions without prior notice.

- All matters and disputes are subject to the final decision of Citibank and the respective merchants.

- In the event of any discrepancy between the English and Chinese versions of these terms and conditions, the English version shall prevail.

Terms and Conditions for Points Accumulations and Redemption:

- Points will be awarded to eligible transactions in accordance with the following criteria:

- a) Basic Point: 1 Point will be awarded per HK$1 (or equivalent foreign currency) transaction posted;

- b) Online Bonus Point: extra 2 Points will be awarded per HK$1 (or equivalent foreign currency) Online Transaction. Online Transactions are transactions with official payment records and classified as online transaction according to the merchant codes/transaction types as defined by relevant card association or a merchant's acquiring bank. Citibank has no obligation to clarify whether an online transaction is an Eligible Transaction before the Cardholder conducts such online transaction. Transactions of “PayAll’ program are not eligible to Online Bonus Point;

- c) Fitness Bonus Point: extra 2 Points will be awarded per HK$1 (or equivalent foreign currency) Fitness Membership Transaction. Fitness Membership Transactions are transactions made at fitness centre which are classified as fitness merchants according to the merchant codes issued by relevant card association.

The Points will be credit to Eligible Card account on the next business day after the transaction is posted.

- Each Eligible Card account is subject to a maximum of 50,000 bonus Points (inclusive of Online Bonus Point and Fitness Bonus Point) per statement cycle.

- Ineligible Transactions including but are not limited to, transactions through Faster Payment System (FPS) services, cash advances, withdrawal amount/loan amount under the Balance Transfer Program, Cash Conversion Program, “FlexiBill” Installment Program and “PayLite” Installment Program and Quick Cash Installment Program, payment to the Inland Revenue Department, online bill payment or utilities bill made with Eligible Card via internet banking or online payment system, insurance transactions and transactions on charity donations/ non-profit organisations (according to the merchant codes issued by Visa, Mastercard Worldwide or UnionPay (as applicable) from time to time), all payments made using mutual funds payment, fees & charges, casino transactions, unposted/cancelled/refunded transactions, other unauthorized transactions and fraud and abuse transactions. Citibank will use reasonable endeavors to collect and receive information mentioned in the transaction description as shared by network/transaction processor with Citibank to identify Octopus Add Value Service transactions.

- All Points earned by the principal and supplementary Cardholders of the same Eligible Card will be accumulated under the principal Cardholder's account.

- Only principal Cardholders are eligible for Points redemption.

- Citibank may add to, or remove from, the list of invalid transactions as stated in Clauses 3 above from time to time at its discretion. The decision of Citibank as to what constitutes an invalid transaction shall be final and conclusive.

- Points earned on Eligible Card are evergreen.

- Should any transaction in the monthly statement be cancelled or refunded for whatever reason, the Points earned in respect to those transactions will be deducted or cancelled.

- Reward points reversal will be applied in the statement cycle when reversal transaction is posted which differ from the statement cycle of corresponding purchase transaction. Accelerated/bonus reward points will be awarded only if cumulative value of new purchase transactions in the respective spend category is higher than the value of transactions reversed.