Pay tax smarter using Citi PayAll

Your annual tax payment can be more than just an expense — turn it into great rewards!

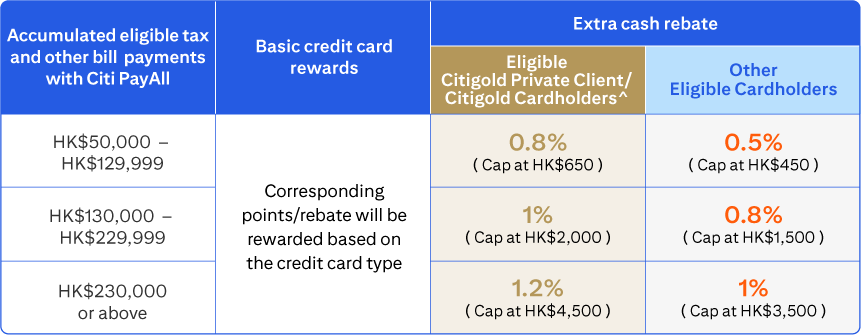

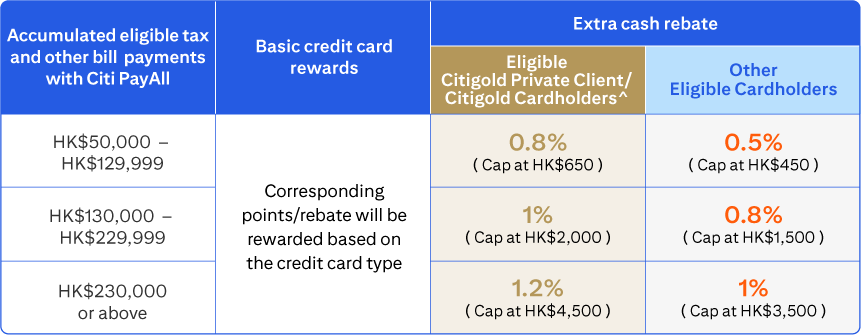

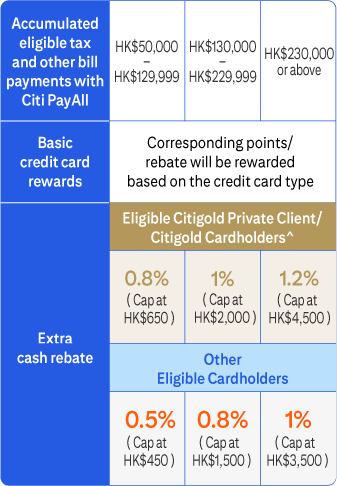

Pay your tax and other bills with Citi PayAll now to enjoy up to an additional HK$4,500

cash rebate plus credit card rewards — getting extra rewards has never been easier!

Promotion Period: From now until March 31, 2026

|

|

|

| ^Eligible for cardholders who hold Citigold Private Client / Citigold banking relationship as of March 31, 2026, and maintain the Citigold Private Client / Citigold banking relationship until June 30, 2026. |

Smart tips: Pay, save and earn with ease!

Used to get nothing back when settling big expenses like tax, insurance, or tuition? Pay with

Citi PayAll now and earn up to 1.2% cash rebate to offset your service fee*, while earning

credit card rewards for less. Make every dollar count and amplify its value!

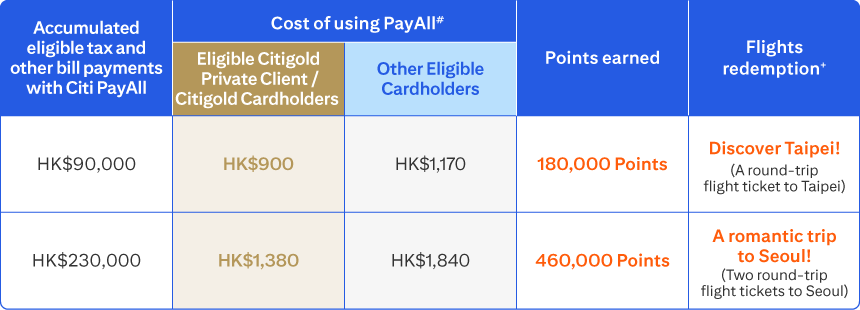

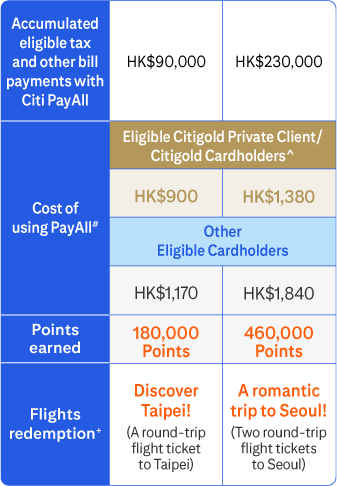

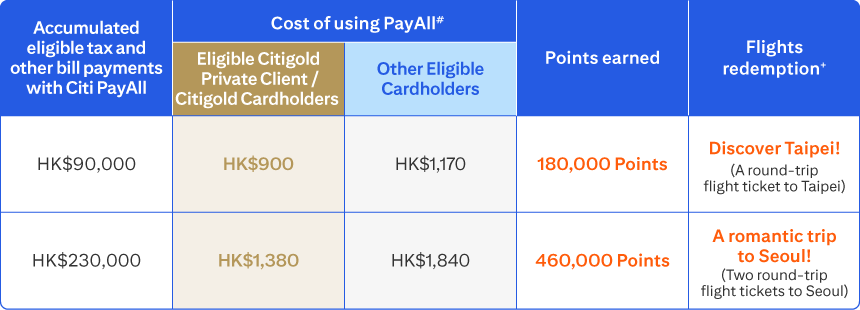

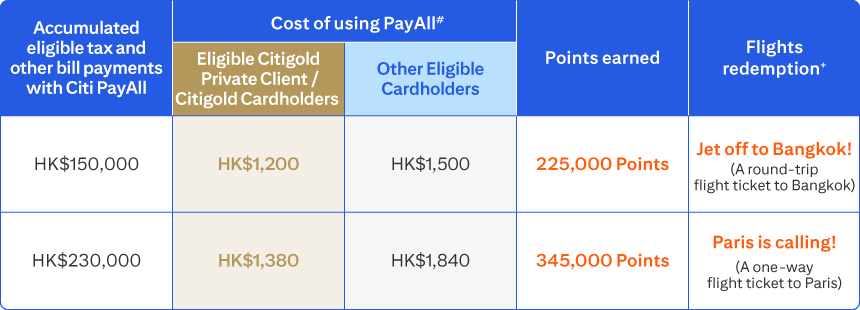

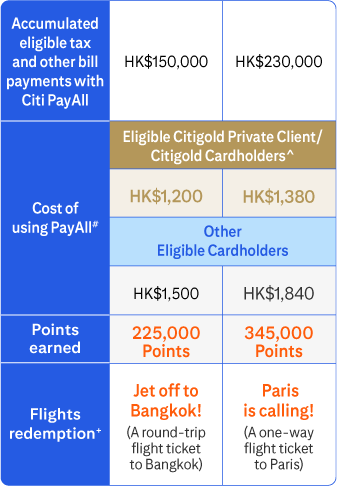

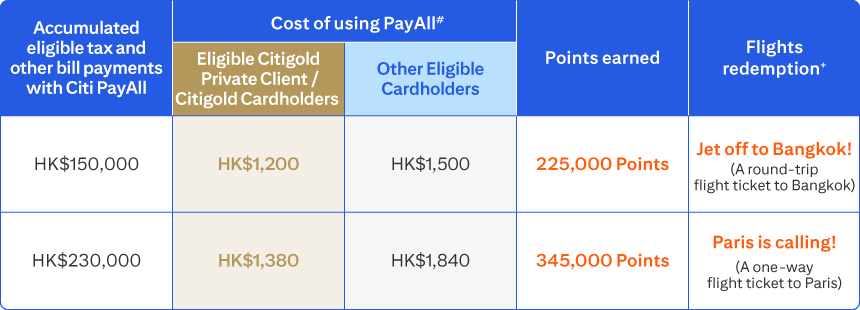

Find out how rewarding Citi PayAll can be — earn the same points for less. Check out the

examples below:

| Using Citi Prestige Card as an example |

|

|

|

| Using Citi PremierMiles Card as an example |

|

|

|

| *PayAll service fee is 1.8%. |

| #Cost of using PayAll is calculated by service fee minus cash rebate. |

| +For reference only, the relevant information may be updated from time to time without prior notice. It is required to turn the entitled points into Miles and redeem relevant air-tickets. Relevant Terms “Citi ThankYouSM Rewards”. |

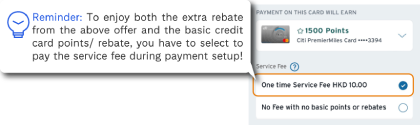

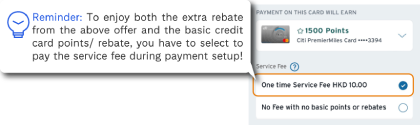

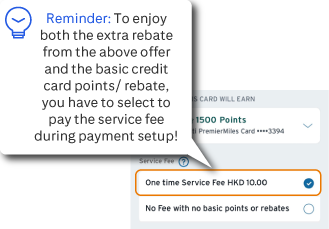

2 steps to earn extra cash rebate

Go to the Get More section on the

Citi Mobile App to register for the

Citi PayAll Tax Payment Campaign

To enjoy the cash rebate, don't forget

to pay the service fee when making

payment using Citi PayAll

Remark

The option for "no Fee with no basic points or rebates" is subject to different payment categories.

Please refer to the relevant page(s) when you set up payment via Citi PayAll. Terms & Conditions for Citi PayAll Service apply.

Settle with Citi PayAll

Settle with Citi PayAllon the tax demand note. Select “1 – Tax” as the

Bill Type and complete the setup

Pay smart, earn more — it’s that easy!

Start now with Citi PayAll.

Useful hacks: Make tax payment a breeze!

Follow these simple hacks before and after payment to ease your tax stress:

Hack 1 :

Hack 1 :

Increase your credit card limit before making your tax payment with Citi PayAll

Get a higher credit card limit to enjoy greater financial flexibility and pay your tax with ease!

![]()

Login to Citi Mobile® App > “Credit Card” > “Available Credit Limit” >

“Looking for more spending power” to apply for a credit card limit increase

Hack 2 :

Hack 2 :

Turn spending into installments after making your tax payment with Citi PayAll

and enjoy extra rebates of up to HK$10,000!

Turn your tax payment into flexible installments, keeping your finances under control — stress-free.

Apply for Citi “PayLite” / Citi “FlexiBill” by March 31, 2026 to enjoy HK$100 cash rebate for every HK$10,000

loan amount with a minimum installment period of 24 months.

The higher the accumulated loan amount, the greater the cash rebate — enjoy up to HK$10,000!

Hack 3 :

Hack 3 :

Become a Citigold Private Client and Citigold customer and pay tax with Citi PayAll.

Enjoy cash rebate and earn welcome rewards

Become a Citigold Private Client and Citigold customer by March 31, 2026,

and pay tax with Citi PayAll to receive an exclusive of up to 1.2% cash rebate (up to HK$4,500),

plus even more fabulous welcome rewards for new customers!

For the details of welcome rewards, please click here to learn more.

Settle Assorted Payments Effortlessly with Citi PayAll

With Citi PayAll, you can settle expenses across a wide range of eligible payment categories, and even send money to designated payees’ bank accounts. Conducting bill payments and fund transfers has never been easier!

How to pay bill with Citi PayAll?

amounts from your credit card |

and payment |

You can apply for Citi PayLite / Citi Flexibill^ through Citi Mobile® App on bills from designated PayAll payment categories*, including Tax, Insurance, etc. Repayment plans can be up to 48 months and you can earn extra rewards!

Remarks

Whenever the time, wherever you are, just a few clicks to start using Citi PayAll on the Citi Mobile® App

Not a Citi Credit Cardholder?

Apply now and experience a world of rewards.

“Citi PayAll 2025 Earn up to HK$4,500 Bonus Rebate Tax Payment Campaign (“Promotion”)” Terms and Conditions

- The Promotion Period is valid from December 1, 2025 to March 31, 2026, both dates inclusive ("Promotion Period"). For payments through Citi PayAll service, eligibility for the offer is based on Payment Due Date. For future dated, monthly and weekly payments, Payment Due Date must be at least 4 Business days (Monday to Friday, except public holidays, Saturday and Sunday) (“Business Days”) after the date of payment setup. For instant Payment, the Payment Due Date is the same as Payment Setup Date. Capitalized terms and expressions used in these Terms and Conditions shall have the same respective meanings as defined in the Citi PayAll Service Terms and Conditions unless the context requires otherwise.

- This Promotion is applicable to selected cardholders who receive the promotional email, SMS, Citi Mobile® App Push Notification or Get More Banner for this Promotion in Citi Mobile® App and have made Registration pursuant to Clause 5 below (“Eligible Cardholders”). Eligible Cardholders must use their Citi Prestige Card, Citi PremierMiles Card, Citi Cash Back Card, Citi The Club Credit Card, Citi Rewards Card (Visa & Mastercard), Citi HKTVmall Card, Citi Octopus Card, Citi Plus® Credit Card and Citi Clear Card issued by Citibank (Hong Kong) Limited ("Citibank") ("Eligible Cards") to settle payments. Citi PayAll is not applicable to Citi Rewards UnionPay Card.

- This Promotion is not applicable to customers who fall into any of the following groups:

- CitiBusiness® Accounts customers;

- U.S. persons (“U.S. Persons” means United States (“U.S.”) citizens, U.S. Residents, U.S. Permanent Residents, U.S. Green Card holders or a person with a U.S. mailing address or U.S. telephone number);

- All International Personal Banking client with an overseas correspondence address.

- This referenced document provides information about, and access to accounts and financial services provided by Citibank (Hong Kong) Limited and Citibank, N.A. Hong Kong Branch in Hong Kong. It does not, and should not be construed as, an offer, invitation or solicitation of services to individuals residing outside of Hong Kong. This referenced document is not intended for distribution to, or use by, any person in any country where such distribution or use would be contrary to local law or regulation, and none of the services or investments referred to in this referenced document are available to persons resident in any country where the provision of such services or investments would be contrary to local law or regulation.

- To be eligible, Eligible Cardholders are required to make a successful one-time registration (“Registered Cardholders”) via Citi Mobile App® “Get More” page during the Promotion Period (“Registration”) in order to participate in this Promotion. Each Eligible Cardholder is required to register once only. Registration with a supplementary card is not accepted.

- Eligible Citigold Private Client / Citigold Cardholders referred to in these Terms and Conditions are Eligible Cardholders who hold Citigold® Private Client / Citigold® banking relationship with Citibank as of March 31, 2026, and maintain the Citigold® Private Client / Citigold® banking relationship until June 30, 2026 (“Eligible Citigold Private Client / Citigold Cardholders”). Other Eligible Cardholders referred to in these Terms and Conditions are Eligible Cardholders who do not hold Citigold® Private Client / Citigold® banking relationship with Citibank as of March 31, 2026 (“Other Eligible Cardholders”).

- If Eligible Cardholders choose to pay Citi PayAll service fee (“Service Fee") for a new Citi PayAll payment setup, the fee will be reflected on “Review & Confirm” page upon payment setup, and it applies to all recurring payments thereafter under the same setup. Registered Cardholders can earn rewards on the relevant Eligible Card ("Basic Credit Card Rewards") subject to the relevant rewards program and extra Cash Rebate Offer (“Promotional Bonus Rebate”) subject to the terms and conditions under this Promotion for the Citi PayAll transactions with Service Fee. If Eligible Cardholders choose to enjoy zero Service Fee, no basic credit card rewards nor Promotional Bonus Rebate from this Promotion will be earned from the respective transaction.

- Eligible Citi PayAll transactions referred to in these Terms and Conditions include only Citi PayAll transactions in respect of which Eligible Cardholders opt to pay Service Fee (“Eligible Citi PayAll Transactions”), and set up and complete the payment setup within the Promotion Period.

- During the Promotion Period, each Eligible Cardholder may qualify for Promotional Bonus Rebate, capped at a maximum of HK$4,500, upon meeting the specified Eligible Citi PayAll Transaction thresholds. Eligibility for this cash rebate is determined by the accumulative Eligible Citi PayAll Transactions conducted within Promotion Period meeting the specified thresholds, as defined in Clause 8. The applicable bonus rebate percentages and corresponding caps are detailed below:

Accumulated Eligible Citi PayAll Transaction Threshold Eligible Citigold Private Client / Citigold Cardholders Other Eligible Cardholders Promotional Bonus Rebate Percentages for Accumulated Eligible Citi PayAll Transactions Promotional Bonus Rebate Cap Promotional Bonus Rebate Percentages for Accumulated Eligible Citi PayAll Transactions Promotional Bonus Rebate Cap HK$50,000 - HK$129,999 0.8% HK$650 0.5% HK$450 HK$130,000 - HK$229,999 1.% HK$2,000 0.8% HK$1,500 HK$230,000 or above 1.2% HK$4,500 1.% HK$3,500 - For instant Payment, Citi Credit Card will be charged on the same day instead, and the Payment Charged Date will be the date of the instant Payment. For future dated, monthly and weekly payments, Citi Credit Card will be charged and debited (with handling fee, if any) at least two Business Days prior to the Payment Due Date. In case the payment due date is a public holiday, Saturday or Sunday, the Payment Charged Date will be three Business Days prior to the payment Due date. For the respective “Purpose of Payment” under “Pay to Designated Merchants”, transaction made through PayAll after 3:30 pm (Hong Kong time) on Monday to Friday, or anytime on Saturday, Sunday and Public Holiday will be handled on next Business Day. Cardholders are responsible for making sure their credit limit is sufficient for the Payment. Each purpose of payment may subject to a monthly cap, please refer to citibank.hk/ptax25 for details.

- If the payment is rejected by third parties other than Citibank, original payment (with handling Service Fee, if any) will be refunded to transacted credit card on the next Business Day after the Payment Due Date.

- The processing of a tax payment transaction will take at least 4 to 5 Business Days. The tax payment transaction is subject to Eligible Card account status checking, the available credit limit and the final discretion of Citibank.

- Citibank will determine the eligibility of Cardholders to participate in this promotion as well as Eligible PayAll Transactions based on Citibank's record and at the sole and absolute discretion of Citibank. If transactions are confirmed to be qualified for the Promotion after verification by Citibank at its sole and absolute discretion, the corresponding Promotional Bonus Rebate will be automatically credited to the last Citi PayAll transacted Eligible Card account (or the corresponding newly issued Eligible Card as referred to Clause 18) and shown in the monthly statement on or before June 30, 2026.

- Any unposted, cancelled or reversed Citi PayAll transactions will not be eligible for any rewards or offers under this promotion.

- Citibank will not accept any liability in relation to any loss of rewards / payment delay incurred due to an incorrect information being provided by the Eligible Cardholder.

- Cancellation / Changes of the transaction are not allowed once processed. In any circumstances that the tax payment cannot be processed, Citibank is not responsible or liable for any claim or loss, and delay in refund of credit balance unless it results from any negligence or willful default on Citibank’s part.

- Citi PayAll Service Terms and Conditions apply. In case of any breach of Citi PayAll Service Terms and Conditions or any abuse of Citi PayAll service, including the circumstances of sending money to Cardholder's own accounts or to recipients who have not provided Cardholders with goods or services, Cardholders will not be entitled to any rewards or offers under this Promotion. Cardholders undertake to provide information, receipt or other documentary proof at any time as Citibank may require showing that a Payment is not a breach of Citi PayAll Service Terms and Conditions nor an abuse of Citi PayAll service. All documents submitted to Citibank will not be returned.

- Cardholders who have registered during the Promotion Period and subsequently have their respective Eligible Card(s) replaced, renewed (Inclusive of renewal from Visa Card to a Mastercard), report lost / stolen, all the eligible transactions made on the corresponding newly issued Eligible Card due to the aforementioned scenarios will be automatically combined with the eligible transactions made with the original Eligible Card, with no additional registration required.

- Citi PayAll Service Terms and Conditions apply to all payments through Citi PayAll service.

- Eligible Cardholders’ Eligible Card accounts must be valid and with good credit record during the Promotion Period and at the time of receiving the Promotional Bonus Rebate in order to be eligible to receive any Promotional Bonus Rebate otherwise Citibank reserves the right to forfeit the Promotional Bonus Rebate without prior notice.

- Cardholders must keep and submit the relevant original credit card sales slips and original merchant sales receipts in respect of the Eligible Retail Transactions for inspection upon request by Citibank. All documents submitted to Citibank will not be returned.

- In case of any fraud/abuse/reversal or cancellation of transactions in respect of which the Promotional Bonus Rebate was awarded, Citibank reserves the right to debit the amount from the same or other Citi Credit Card account(s) without prior notice.

- Citibank reserves the right to amend these terms and conditions or withdraw or terminate this promotion at its discretion without prior notice and Citibank accepts no liability for such amendment, withdrawal or termination. All matters and disputes are subject to the final decision of Citibank.

- In the event of any discrepancy between the English and Chinese versions of these terms and conditions, the English version shall prevail. If there is any discrepancy between the promotional materials and these terms and conditions, these terms and conditions shall apply and prevail.

- No person other than eligible Cardholders and Citibank will have any right under the Contracts (Rights of Third Parties) Ordinance to enforce or enjoy the benefit of these terms and conditions.

- These terms and conditions are governed by and construed in accordance with the laws of the Hong Kong Special Administrative Region.

Terms & Conditions for Citi PayAll Service:

Please click here for detailed Terms and Conditions

Terms and Conditions for Citi Credit Card "FlexiBill" Installment Program and Citi Credit Card "PayLite" Installment Program and Terms and Conditions for other promotion offers:

Please click here for detailed Terms and Conditions